Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. And we constantly review our criteria to ensure we’re putting accuracy first.īankrate follows a strict editorial policy, so you can trust that we’re putting your interests first.

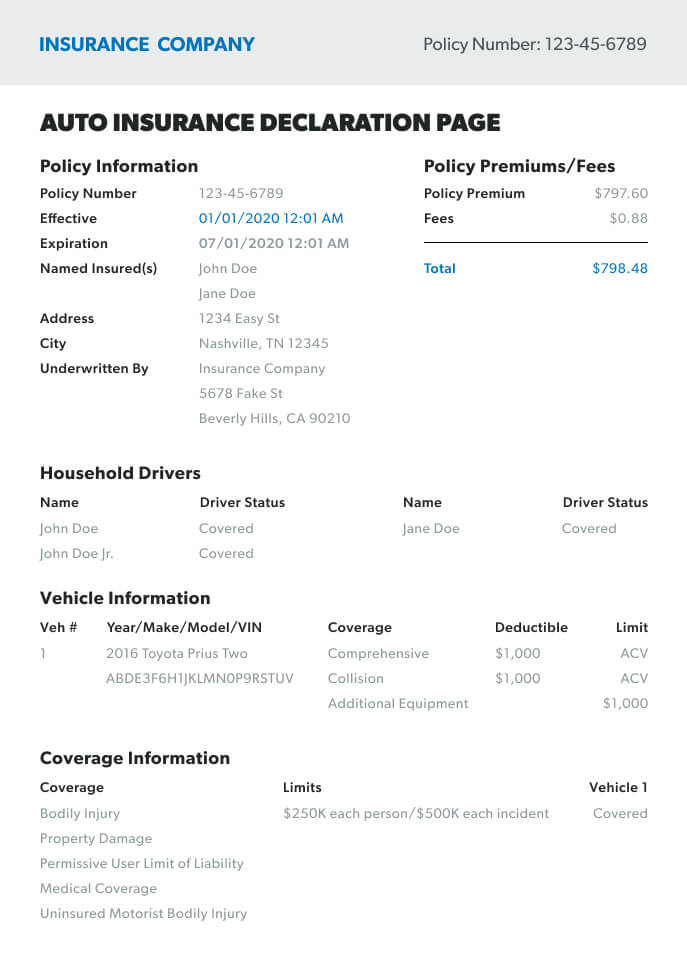

We guide you throughout your search and help you understand your coverage options.They focus on the points consumers care about most - price, customer service, policy features and savings opportunities - so you can feel confident about which provider is right for you. Our insurance team is composed of agents, data analysts, and customers like you. Who ensure everything we publish is objective, accurate and trustworthy. Highly qualified professionals and edited by So you can trust that we’re putting your interests first. Process and giving people confidence in which actions to take next.īankrate follows a strict editorial policy, We’ve maintained this reputation for over four decades by demystifying the financial decision-making What to do when you lose your 401(k) matchįounded in 1976, Bankrate has a long track record of helping people make smart financial choices. Should you accept an early retirement offer? The name of your financial institution will show on the Lienholder section, along with a loan number and the bank’s address.How much should you contribute to your 401(k)? This is crucial for anyone still paying for their automobile. You may also see lienholder and additional interest data shown on your dec page. That’s the amount of money you need to pay personally before your insurer starts to pay for your post-accident messes. Here you can find where your deductible is listed. For example, $100,000 per person, $300,000 per accident in Bodily Injury Liability or $5,000 per person in Medical Expenses. Here, you’ll find the run down of Bodily Injury Liability, Property Damage, Personal Injury Protection, Comprehensive and Collision, Medical Payments, Rental Reimbursement and any other plans you have purchased.Įach type of coverage will be listed here with its corresponding limit. This is a very important section to indicate what policies are included in your car insurance package.

Insurance declaration page drivers#

Policy periods are normally 6 months in duration and renew automatically if you pay on time and have an active payment plan set up.Ī list of Named Insured Drivers on your policy, including yourself, your spouse, any family members or other designated individuals you list on your policy.

Here on your declarations page, you can find where you receive any reductions in cost, whether that’s a bundle with home insurance or a reward for safe driving.ĭates will be listed in this area to clarify when your coverage starts, renews, and ends, typically based on when you pay your bill. The total shows the amount for all cars insured on your plan.ĭiscounts. This section displays how much you pay each month for coverage for all listed drivers on each vehicle.Įach car has its own premium amount.

Insurance declaration page how to#

How to Read a Car Insurance Policy Declarations PageĪ listing of each vehicle included on your policy, with Year, Make, Model, VIN Number, and the Type of Car Insured. Renewal Periods typically take place every 6 months. You can expect to receive a new declarations page each time you renew.

0 kommentar(er)

0 kommentar(er)